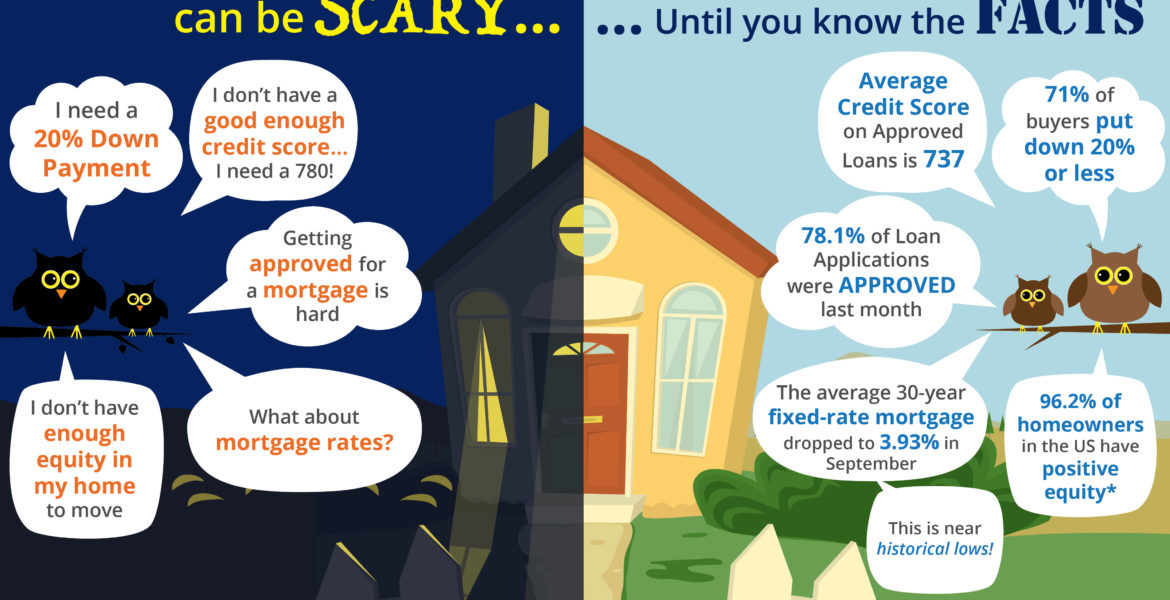

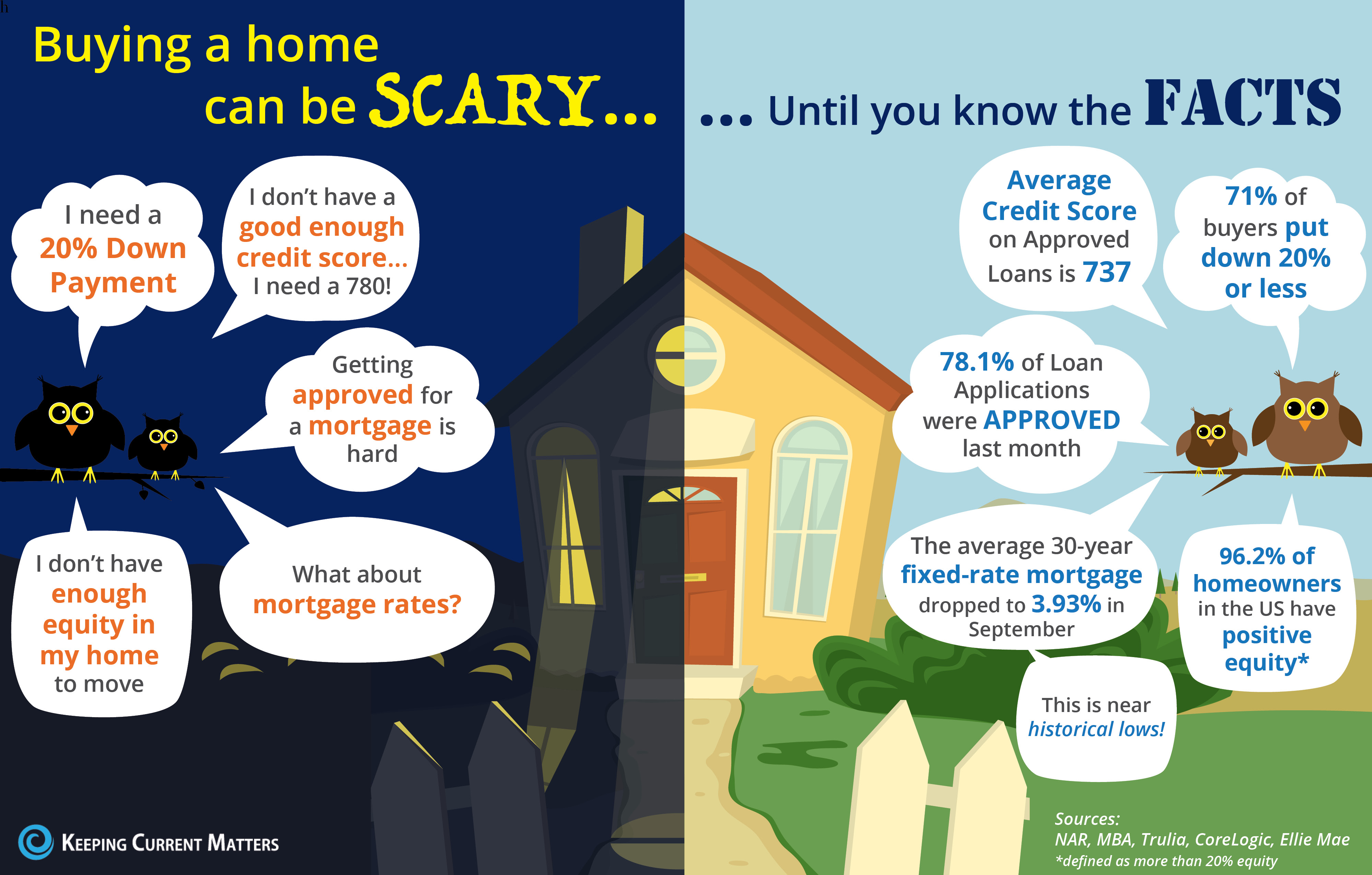

Home Loans Don’t Have To Be Scary!

Many potential homebuyers believe they need a 20% down payment and a 780 FICO® score to qualify to buy a home. This stops many people from even trying to jump into homeownership! Here are some facts to help take the fear out of the process:

71% of buyers who purchased homes have put down less than 20%.

78.1% of loan applications were approved last month.

In September, the average credit score for approved loans was 737. This means many buyers had lower scores!

Plus, if you can qualify for a DPA program, you might be able to buy using very little OR NONE of your own money!

What Are Closing Costs?

Learn more about what fees you as a borrower pay when you close on the purchase of a home or other property, and how much you should budget for them!

Read moreLearn more about what fees you as a borrower pay when you close on the purchase of a home or other property, and how much you should budget for them!

What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. You may have more options than you think!

Read moreThere are many misconceptions about the credit score needed to buy a house. You may have more options than you think!

National Homeownership Month

The benefits of homeownership may reach farther than you think! For National Homeownership Month we feature some of the best benefits of owning a home!

Read moreThe benefits of homeownership may reach farther than you think! For National Homeownership Month we feature some of the best benefits of owning a home!

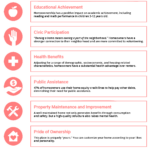

Reasons to Fall in Love with Homeownership

There are many benefits to love about homeownership, and they’re not all financial. Being a part of a neighborhood, driving academic achievement, and improving mental health are just a few of these advantages. Check out the chart below to learn more!

Read moreThere are many benefits to love about homeownership, and they’re not all financial. Being a part of a neighborhood, driving academic achievement, and improving mental health are just a few of these advantages. Check out the chart below to learn more!