The Truth About Your Down Payment

According to the ‘2019 Home Buyer Report’ conducted by Nerdwallet, many first-time buyers still believe they need a 20% down payment to buy a home in today’s market:

“More than 6 in 10 (62%) Americans believe you must put at least 20% down in order to purchase a home.”

When potential homebuyers think they need a 20% down payment to enter the market, they also tend to think they’ll have to wait several years (in some markets) to come up with the necessary funds to buy their dream homes. The report continues to say,

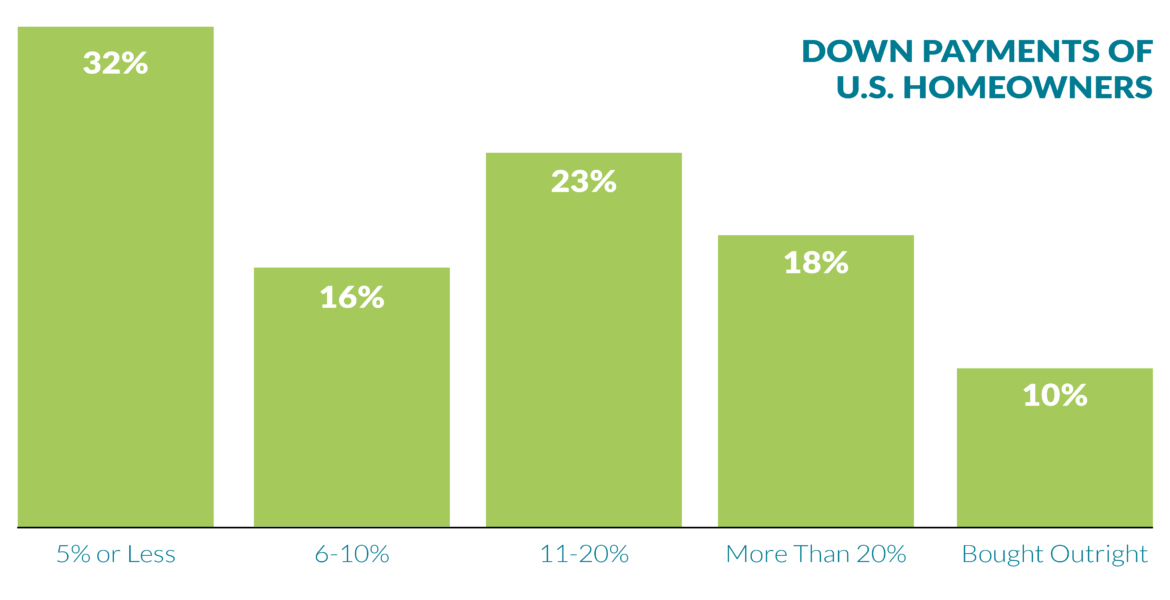

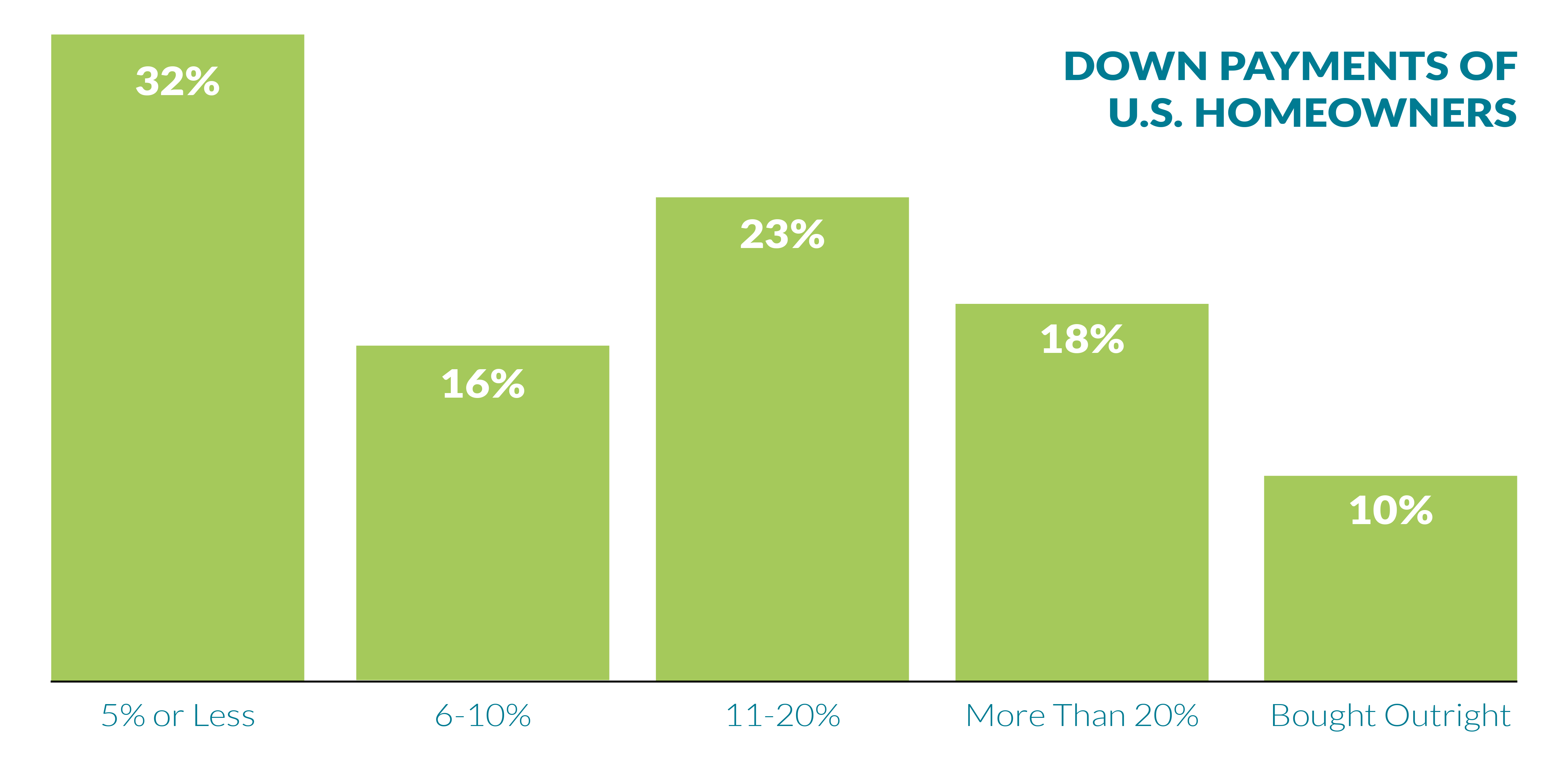

“The truth: 32% of current U.S. homeowners put 5% or less down on their home, according to census data.” (as shown below):

Don’t let a lack of understanding keep you and your family out of the housing market! Ask us about our many different GRANT programs that could cover your down payment and in some cases a portion of the closing costs!

Learn more about what fees you as a borrower pay when you close on the purchase of a home or other property, and how much you should budget for them!

There are many misconceptions about the credit score needed to buy a house. You may have more options than you think!

The benefits of homeownership may reach farther than you think! For National Homeownership Month we feature some of the best benefits of owning a home!

There are many benefits to love about homeownership, and they’re not all financial. Being a part of a neighborhood, driving academic achievement, and improving mental health are just a few of these advantages. Check out the chart below to learn more!