This is Not 2008 All Over Again: The Mortgage Lending Factor

Some are afraid the real estate market may be looking a lot like it did prior to the housing crash in 2008.

The Mortgage Bankers’ Association releases an index several times a year titled: The Mortgage Credit Availability Index (MCAI). According to their website:

Basically, the index determines how easy it is to get a mortgage. The higher the index, the more available the mortgage credit.

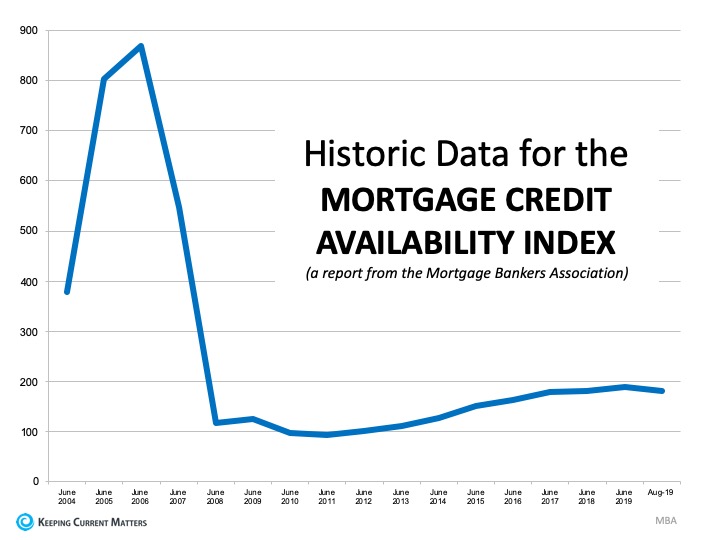

Here is a graph of the MCAI dating back to 2004, when the data first became available:

As we can see, the index stood at about 400 in 2004. Mortgage credit became more available as the housing market heated up, and then the index passed 850 in 2006. When the real estate market crashed, so did the MCAI (to below 100), as mortgage money became almost impossible to secure.

Thankfully, lending standards have eased since. The index, however, is still below 200, which is half of what it was before things got out of control.

Bottom Line

It is easier to get a mortgage today than it was immediately after the market crash, but it is still more difficult. than it was in 2006. The difference in 2006? At that time, it was difficult not to get a mortgage.

Learn more about what fees you as a borrower pay when you close on the purchase of a home or other property, and how much you should budget for them!

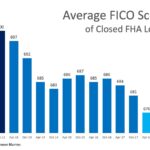

There are many misconceptions about the credit score needed to buy a house. You may have more options than you think!

The benefits of homeownership may reach farther than you think! For National Homeownership Month we feature some of the best benefits of owning a home!

There are many benefits to love about homeownership, and they’re not all financial. Being a part of a neighborhood, driving academic achievement, and improving mental health are just a few of these advantages. Check out the chart below to learn more!