What Are Closing Costs?

Mortgage closing costs are the fees you pay when you secure a loan, either when buying a property or refinancing. These costs include application fees, attorney’s fees, real estate sales and lender commissions, taxes, and discount points, if applicable. You should expect to pay between 2% and 5% of your property’s purchase price in closing costs. If you’re buying mortgage insurance, these costs can be even higher.

When Does a Seller Pay Closing Costs?

There are some closing costs that sellers almost always pay themselves. These include real estate agent commissions, prorated real estate taxes and transfer taxes. In certain cases, sellers may also pay the cost of a home warranty (if they’re providing one) and fees for any associations that their property belongs to.

In addition to these items, there are other costs that sellers may also pay, such as real estate commissions and title preparation fees. Ultimately, though, it’s all a matter of negotiation between buyer and seller.

If, on the other hand, you’re refinancing your home, you’ll be responsible for all closing costs.

What is Included in Closing Costs?

The specific items included in closing costs vary from transaction to transaction and depend on the individual buyer, seller, property, property type, loan type and loan amount. While not all of these costs are paid by buyers, they are numerous:

Appraisal Fee

When buyers get a mortgage on a property, their lender wants to know the property is worth more than they’re lending against it—because, if you default, the lender will need to sell your property in order to get their money back. So, they have it appraised. These appraisals may be paid for separately or added to the loan balance.

Inspection Fee

Inspections are done to check the state of a property before the lender issues a loan. Similar to an appraisal, lenders want to make sure the property they’re lending against is in good condition and not affected by things such as termites or water damage. Also, like appraisal fees, these costs may be paid separately or can sometimes be added to a buyer’s loan balance.

Loan Origination Points

Loan origination fees are a percentage of the loan value that borrowers pay in order to secure their loan. These points may cover the loan origination fee (usually a flat amount) as well as an application fee that some lenders charge. Points may also cover other fees charged by lenders, loan broker fees and other costs.

Mortgage Discount Points

Some lenders offer borrowers the option of lowering their interest rate in exchange for prepaying a portion of the interest due over the term of their loan. This is called “buying down” an interest rate. For every 1% of interest that borrowers prepay, they can usually lower the interest rate for the term of their loan by about 0.25%.

Mortgage Insurance Premium

If you make a down payment of less than 20%, your lender may require you to buy private mortgage insurance (PMI), which can involve upfront premium payments. If you use a government loan, such as an FHA or USDA loan, you will have to pay premiums for mortgage insurance provided by those programs.

Prorated Real Estate Taxes

When someone sells a property, they’re usually required to pay the real estate taxes for the portion of the year for which they’ve held the property. This is because the buyer will pay the real estate taxes for the full year when they get their property tax bill at the next billing cycle. The seller is simply crediting back the real estate taxes due for the portion of the year they owned the property.

Real Estate Commissions

Real estate commissions are usually paid by sellers when properties are listed for sale. These costs are usually at least 5% to 6% of the purchase price, but can be 10% or more, depending on the specific broker and property type.

Recording Fee

When someone buys real estate, a new deed showing their ownership must be filed with the local county recorder. This document shows the new ownership of the property, and counties typically charge a nominal fee for filing the new deed.

Stamp tax

Transfer tax is owed when ownership of real property transfers from a seller to a buyer. In many cases, these taxes are small, but they can be substantial in some areas of the country.

Survey Fee

If a survey hasn’t been done in a while or is unclear from previous deeds, a property may need a new survey before preparing the new deed. Surveyors outline the dimensions of a property to create a map that outlines legal boundaries and land features. Surveys also are necessary if someone is buying part of a parcel or buying multiple parcels that may be combined as part of the sale.

Title Fee

This is a fee that an attorney or title company charges for checking the title for a property. As part of this process, the attorney checks to make sure that the seller can actually convey a clean title and there are no liens or other encumbrances. They also prepare a new deed as part of the sale. The cost for these services usually ranges from a few hundred to a few thousand dollars depending on the state in which you live.

Title Insurance

Title insurance protects a buyer in case there are problems with the title from before purchase or if problems arise later if, for example, someone files a fraudulent deed trying to take possession of their property (a common form of fraud). If something happens that reduces the buyer’s interest in their property, title insurance will cover the cost to fix it.

Where Can I See My Closing Costs?

The specific closing costs of a real estate transaction—and whether costs are the responsibility of buyers or sellers—are all outlined in the disclosure sections of a purchase agreement and determined by the lender and loan type that the buyer selects.

As for the mortgage itself, you can find your mortgage closing costs in two places: the loan estimate and the closing disclosure, both of which your lender is required to provide. The disclosures vary by lender but must include the total loan amount, interest rate, annual percentage rate and monthly payment schedule.

The Bottom Line

The closing costs owed when someone purchases a property can be substantial. Specific closing costs vary depending on the type of property you’re buying, whether you’re using financing and even your specific purchase agreement. While some of these items are paid by sellers, buyers should expect to pay 2% to 5% of their purchase price upfront as closing costs, in addition to their down payment.

Information via Forbes.com

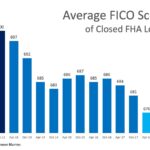

There are many misconceptions about the credit score needed to buy a house. You may have more options than you think!

The benefits of homeownership may reach farther than you think! For National Homeownership Month we feature some of the best benefits of owning a home!

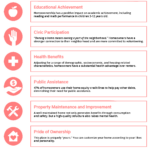

There are many benefits to love about homeownership, and they’re not all financial. Being a part of a neighborhood, driving academic achievement, and improving mental health are just a few of these advantages. Check out the chart below to learn more!

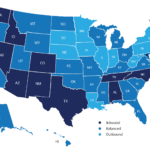

Every year Atlas Van Lines conducts their Migration Patterns Study by tracking their customers' movement state-to-state during the course of the year. See the top states...