Blog

This is Not 2008 All Over Again: The Mortgage Lending Factor

Some are afraid the real estate market may be looking a lot like it did prior to the housing crash in 2008. The Mortgage Bankers’ Association releases an index several times a year titled: The Mortgage Credit Availability Index (MCAI). According to their website:

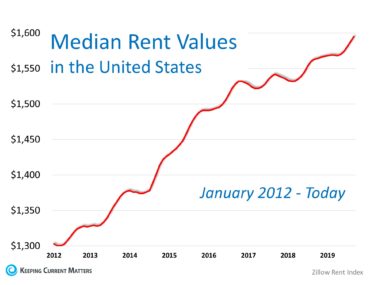

Think Prices Have Skyrocketed? Look at Rents.

Much has been written about how residential real estate values have increased since the housing market started its recovery in 2012. However, little has been shared about what has taken place with residential rental prices. Let’s shed a little light on this subject: